Latest News

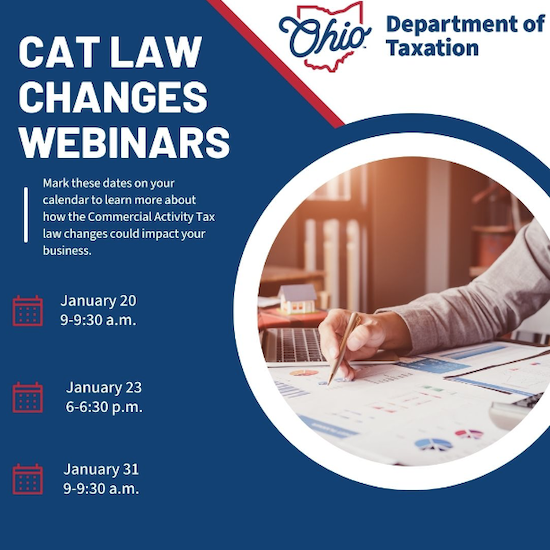

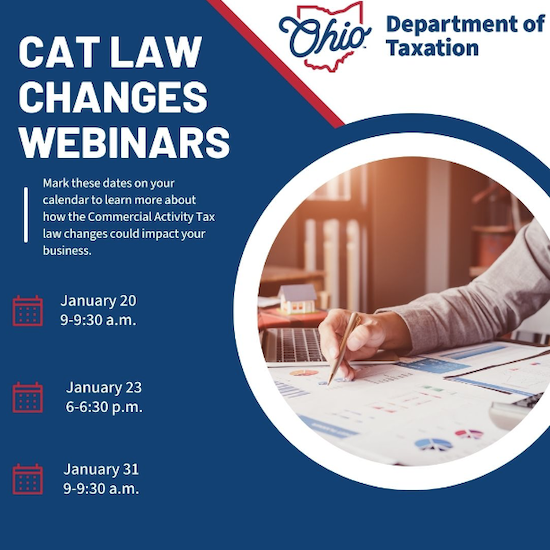

ODT hosting webinars on upcoming CAT law changes & reminds CPAs of CAT return deadline

Written on Jan 12, 2024

Registration open for webinar times:

January 20, 2024, 9–9:30 am Click here to register.

January 23, 2024, 6–6:30 pm Click here to register.

January 31, 2024, 9-9:30 a.m. Click here to register.

The fourth quarter 2023 CAT return is due Feb. 12.

If you anticipate having $3 million or less in taxable gross receipts in tax year 2024, we recommend that you cancel your CAT account. You may do so by using the cancelation check box on the tax return or by visiting the Gateway at gateway.ohio.gov and selecting the CAT Cancel Account transaction. When canceling your account, please enter an effective date of Dec. 31, 2023.

Taxpayers are required to file and pay the CAT electronically via the Ohio Business Gateway at gateway.ohio.gov.