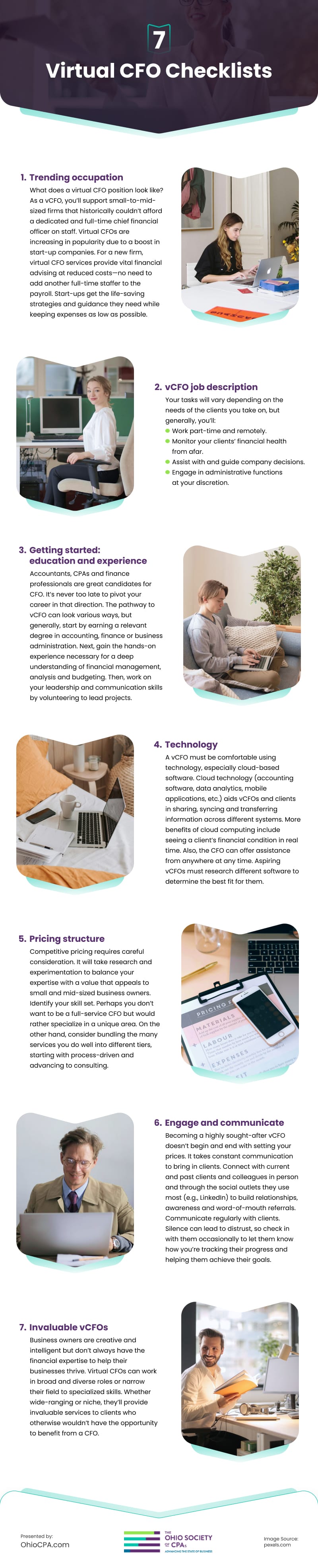

Become a virtual CFO

(Karolina Grabowska / pexel

1. Further your career in today’s competitive market while choosing where and who you work for.

2. Go above and beyond providing fundamental accounting elements to your clients.

3. Virtually deliver more valuable services that appeal to small and mid-sized businesses.

Become a vCFO

If the opportunities above sound appealing, consider becoming a virtual CFO. The role of vCFO centers around computer-based intelligence you can employ from anywhere, anytime. Not only will you increase your value, but you’ll advance your career while gaining flexibility and role diversity.

Trending occupation

What does a virtual CFO position look like? As a vCFO, you’ll support small-to-mid-sized firms that historically couldn’t afford a dedicated and full-time chief financial officer on staff.

Small business is the backbone of the economy. However, many fledgling ventures fail within the first few years. Helping burgeoning businesses succeed aids the entire economy.

Virtual CFOs are increasing in popularity due to a boost in start-up companies. For a new firm, virtual CFO services provide vital financial advising at reduced costs—no need to add another full-time staffer to the payroll. Start-ups get the life-saving strategies and guidance they need while keeping expenses as low as possible.

Enhanced technology allows CFOs to contract out their services at scale. Using cloud-based software, CFOs can manage many clients from anywhere in the world at any time. Small and mid-sized businesses appreciate the ability to outsource their CFO affordably.

Additionally, new technology automates many fundamental and time-consuming financial services. Technology has lowered the value of those primary functions, such as reconciliation and tax preparation. As a result, critical thinking skills, like analyzing and consulting, have become high-value.

vCFO job description

Tech is vital to the role. Utilize technology to advise clients worldwide as a virtual CFO from wherever you choose to do business.

See in-depth financials on your clients in real time. Help them make quick business decisions by meeting virtually to discuss your findings and assessments. Your insight and communication will help you become your clients’ most trusted consultant.

Your tasks will vary depending on the needs of the clients you take on, but generally, you’ll:

- Work part-time and remotely.

- Monitor your clients’ financial health from afar.

- Assist with and guide company decisions.

- Engage in administrative functions at your discretion.

Getting started: education and experience

Accountants, CPAs and finance professionals are great candidates for CFO. It’s never too late to pivot your career in that direction. The pathway to vCFO can look various ways, but generally, start by earning a relevant degree in accounting, finance or business administration.

Next, gain the hands-on experience necessary for a deep understanding of financial management, analysis and budgeting. Then, work on your leadership and communication skills by volunteering to lead projects.

Never stop learning. Keep up with industry trends and pursue advancements in your field and education.

Join forces with national and local accounting membership organizations for further developmental opportunities. Professional societies, like The Ohio Society of CPAs, keep you informed regarding career-boosting CPE education credits and news-worthy information affecting your industry. Additionally, they help you further your career in countless ways, such as with their networking and mentorship opportunities.

Technology

A vCFO must be comfortable using technology, especially cloud-based software. Cloud technology (accounting software, data analytics, mobile applications, etc.) aids vCFOs and clients in sharing, syncing and transferring information across different systems.

More benefits of cloud computing include seeing a client’s financial condition in real time. Also, the CFO can offer assistance from anywhere at any time.

Aspiring vCFOs must research different software to determine the best fit for them. A software’s reliability and security features are vital. vCFOs must update their tech periodically to remain competitive and relevant.

Pricing structure

Competitive pricing requires careful consideration. It will take research and experimentation to balance your expertise with a value that appeals to small and mid-sized business owners.

Identify your skill set. Perhaps you don’t want to be a full-service CFO but would rather specialize in a unique area.

On the other hand, consider bundling the many services you do well into different tiers, starting with process-driven and advancing to consulting.

Research what others are doing. Use your networking circles to find a knowledgeable professional to advise you.

Engage and communicate

Becoming a highly sought-after vCFO doesn’t begin and end with setting your prices. It takes constant communication to bring in clients. Connect with current and past clients and colleagues in person and through the social outlets they use most (e.g., LinkedIn) to build relationships, awareness and word-of-mouth referrals.

Communicate regularly with clients. Silence can lead to distrust, so check in with them occasionally to let them know how you’re tracking their progress and helping them achieve their goals.

Invaluable vCFOs

Business owners are creative and intelligent but don’t always have the financial expertise to help their businesses thrive. As a vCFO, you provide:

- An affordable option

- Business-saving insights

- Realistic financial goals

- Budgeting

- Forecasting

- Fresh knowledge about market trends

- Wise spending advice

- Strategies

- Assurance

- Assessments of risks and opportunities

Virtual CFOs can work in broad and diverse roles or narrow their field to specialized skills. Whether wide-ranging or niche, they’ll provide invaluable services to clients who otherwise wouldn’t have the opportunity to benefit from a CFO.

Infographic

Consider embracing the role of a virtual CFO for flexible career advancement. Virtual CFOs support small-to-mid-sized firms with essential financial guidance, reducing startup costs. It is ideal for accountants and finance professionals who operate remotely, oversee financial well-being, and leverage cloud technology for seamless collaboration. Specialize, set competitive pricing, and prioritize communication for lasting client relationships. Advance your career and become a vCFO with the help of our infographic.