What skills does a college student need to become a successful accountant?

(Anna Shvets / pexels)

Accounting is an ever-changing industry. We must continually practice and add to our technical skills while utilizing softer skills (organization and communication) to manage time, people and projects. Whether you’re exploring career options, working towards your accounting degree or already have your CPA license, you’ll be better prepared for the job market knowing what prospective employers are looking for in an ideal accountant candidate. Below are some skills to make you more attractive to employers.

Technical skills

Understanding accounting procedures — At the very least, budding accountants must have familiarity with GAAP (Generally Accepted Accounting Principles). These standards ensure that all companies in any industry across the US record and report alike. Understanding regulatory requirements regarding corporate and public finances is also crucial. Your firm grasp of these basics will help assure potential employers that you can adhere to financial reporting standards with integrity.

Proficiency in accounting software — Practical experience with tax software can make you stand out as a potential employee. Technological advances constantly change accounting duties, so it’s best to have a broad and deep understanding of many different kinds. One of our favorite pieces of advice is to get some inside information on any potential employer’s software preference by asking an employee who works there. Then, research it before your interview.

Standard spreadsheet software, like Excel, continues to be a cornerstone in general accounting. Additionally, any business analytics software will be a plus as it transforms raw data into information that guides business decisions. Future accountants would be wise to have experience with any of the following software:

AI

Process automation

Financial modeling

Reporting and analysis

Project management

Financial statements

Compliance

Tax

ERP (Useful in upper-level positions to manage supply chains, manufacturing and operations.)

Ability to prepare financial statements — Technology and accounting have evolved simultaneously over the millennia. Still, financial statements are at the heart of the art. These documents depict a timeline of business activity and provide a snapshot of fiscal position. They offer clients and executives in-depth and real-time analyses of financial conditions.

The three most common statements to become familiar with include:

Profit & loss/Income statements

Cash flow/Movement of cash statements

Balance sheets/Assets, liabilities and equity statements

You’ll best serve your employer and clients when you learn to create, track and report on these financial pictures in an easily understood way.

Knowledge of general business practices — It’s easier to serve internal and external clients with the specialized financial support they require if you have a foundation in business. You can take business courses as part of a concentration in leadership management or an MBA. These courses give you a deeper understanding of what your clients or employers need most from the data you provide. You can better assist them and boost your value as an accountant.

Data collection and analysis skills — Today’s accountants must be able to pull specific data from large volumes of information. They must take raw data and convert it to valuable facts (sometimes complete with advice). They identify patterns, catch errors and distinguish fraud from mistakes. Learning data query language is especially helpful.

Critical thinking skills — Accounting is ever-challenging, and professionals must find the best solutions for everyday dilemmas like unbalanced spreadsheets, reporting errors and ethical predicaments. Consider data from multiple angles to form solutions while staying within ethical guidelines. Learn from the mistakes and successes of others’ situations. Employers want to see you can independently research information and answers, consider many approaches to an issue and overcome obstacles using deductive reasoning.

Soft skills

Soft skills are those abilities that are difficult to teach in a classroom setting but can be improved with practice if they don’t come naturally. Work to develop the following:

Organizational skills — Staying organized is crucial since an accountant must simultaneously manage numerous tasks and clients. Neat files and records translate to more effective and accurate work that you, coworkers and clients can locate when needed. Organized information is also more easily understood.

Time management skills —Whether you use a traditional desk calendar or an automated one that alerts you what to do and when, know the due dates for each project and prioritize your time accordingly. When you meet deadlines, you gain motivation and a reputation for reliability. Remember to stay flexible enough to handle any urgent matters that pop up.

Written and verbal communication skills — You’ll need to interact with and pass information to coworkers, bosses, clients and business professionals in various ways. Your accounting career will involve written and oral reports, team projects, briefings and in-person and virtual presentations. Even emails must be carefully crafted and worded so that information is concise and easily understood, so you’ll need to feel confident handling an assortment of communications.

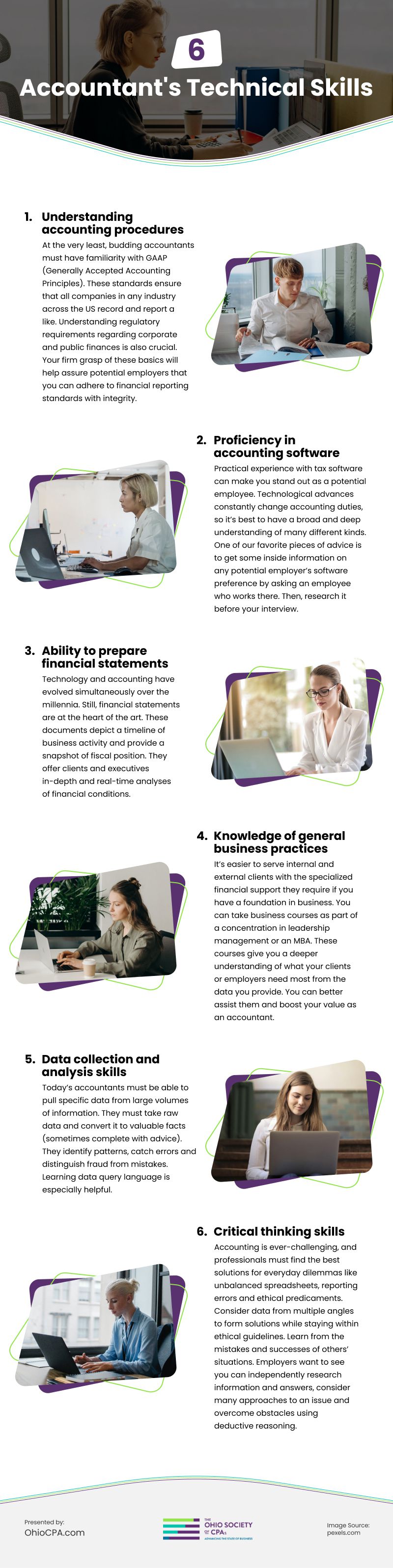

Infographic

If you are someone who is exploring career options, pursuing an accounting degree, or already possessing a CPA license, it's essential to know what qualities and skills potential employers seek in an ideal accountant candidate. Discover the six accountants' technical skills in this infographic that can make you more appealing to employers and better prepare you for the job market.