The Ohio House on Dec. 18 voted to concur with Senate changes on Sub. H.B. 238, OSCPA-backed legislation now before the Ohio Legislature. Next up is consideration by Gov. Mike DeWine. If signed into law by the Governor, new approaches will be adopted in Ohio that will address the challenges the CPA profession is now facing: the shrinking population of CPAs caused by retirements and too few new licensees, and strengthening existing interstate mobility laws to protect current licensees in the future. Workforce challenges and the resulting negative impact on the ability of businesses, governments and others to obtain the professional CPA services they need are the top issues we hear from OSCPA members.

Two primary solutions are contained in Sub. H.B. 238:

1. Removing Unnecessary Barriers

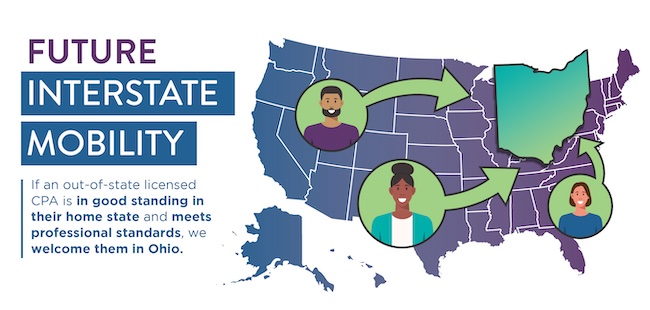

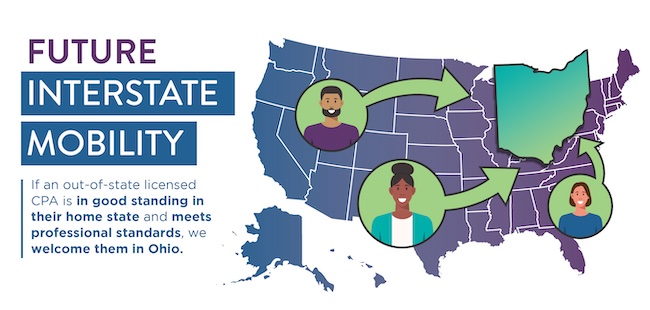

Automatic mobility updates: Our proposal ensures qualified CPAs from out-of-state can work in Ohio seamlessly. This approach provides businesses continued access to top-tier talent while maintaining essential guardrails to protect current licensees and the public. The legislation improves existing interstate mobility laws by evaluating candidates on their individual professional status rather than what state they are licensed in.

This is necessary as numerous states besides Ohio are currently working to enact additional education pathways, and a third-party national association has indicated it could – upon their decision – change its “substantial equivalency” status to restrict all licensed CPAs from a state adding a second educational pathway from continued interstate practice. As written, as long as an out-of-state CPA is licensed in good standing, has at least a bachelor’s degree, an accounting concentration and passed the CPA Exam, they are welcome to come into Ohio to provide occasional services to Ohio clients without notification or fees. Many states also are working to adopt similar language.

The call for automatic mobility is growing louder, with leading national firms recognizing its positive impact. As highlighted in a recent CFO Dive article, this initiative could open doors for CPAs nationwide, enhancing their careers and strengthening the profession.

2. Modernizing Educational Pathways

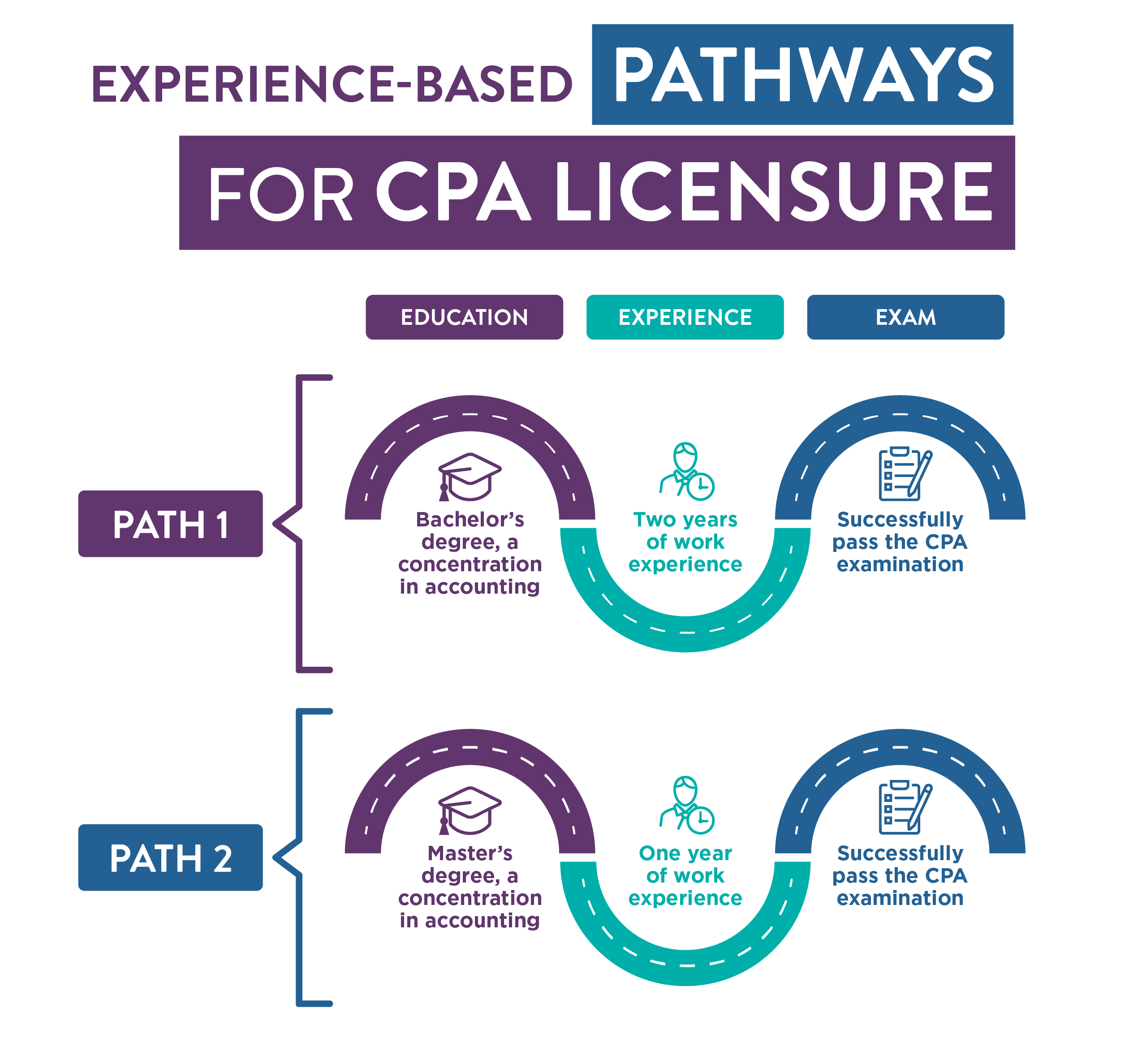

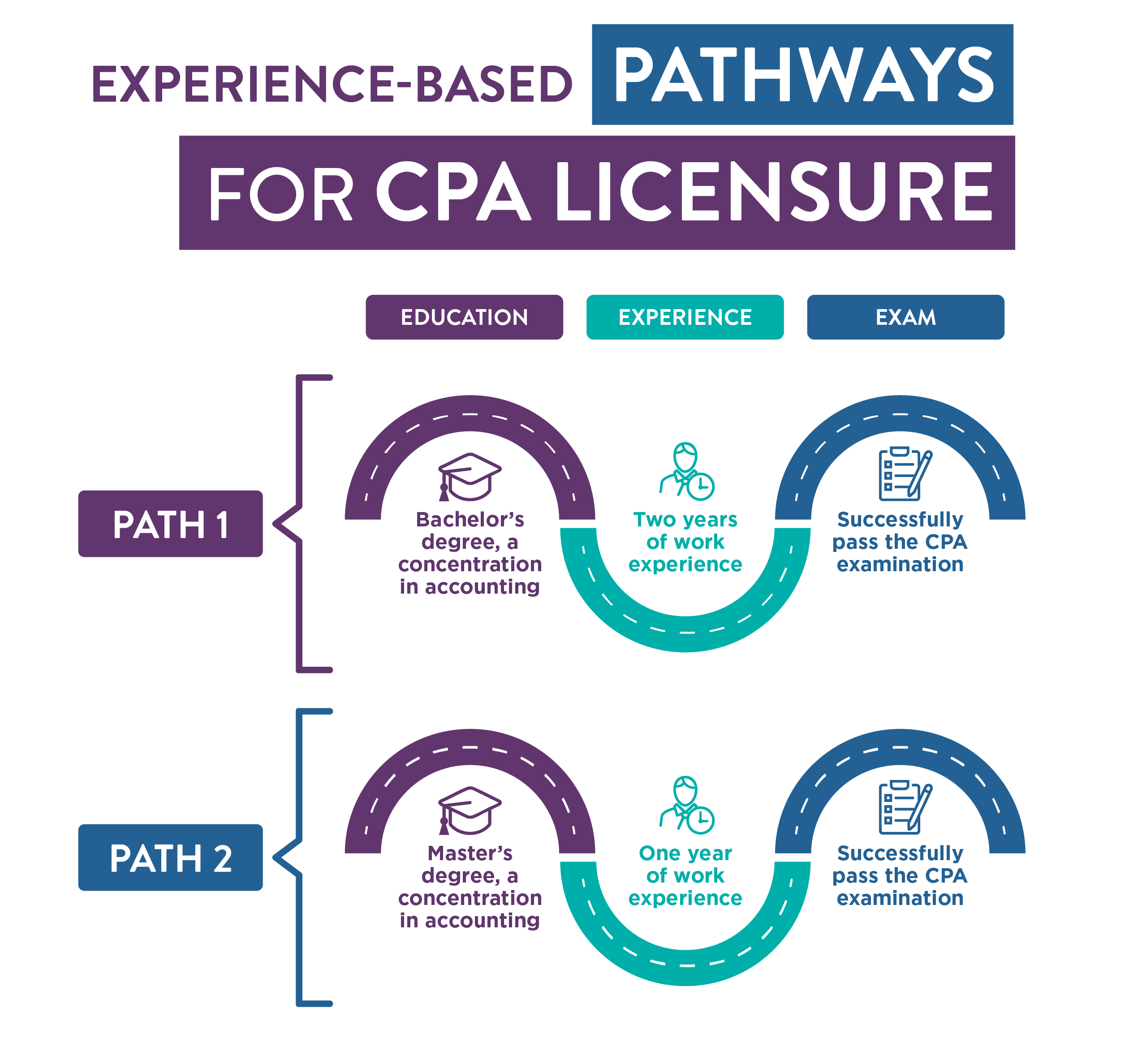

Antiquated requirements are discouraging many promising candidates, especially from underrepresented groups, from pursuing a CPA license. By introducing an alternative pathway to licensure that replaces a year of college education with a second year of experience, we aim to attract more talent while upholding the integrity of our profession. If passed, starting January 1, 2026, Ohio candidates will have two different options for licensure:

i. A master’s degree, completing the required accounting concentration of coursework, one year of experience and passing the CPA Exam

ii. A bachelor’s degree, completing the required accounting concentration of coursework, two years of experience and passing the CPA Exam

If approved by Gov. DeWine, the automatic provisions will take effect 90 days after he signs the new law, and the pathways changes will take effect January 1, 2026.

Currently, 25 states are in the process of or planning to adopt automatic mobility changes in their own states, six more states are actively considering and four others already have it in law, and 30 states are in the process of or planning to adopt a bachelor’s degree pathway with as many as 10 actively considering it.