Benefits of a forensic accountant consultant

(Andrea Piacquadio / pexels)

In past blogs, we’ve touched on some off-the-beaten-path accounting careers. Working with the criminal justice system as a forensic accountant is one such specialized track. As a forensic accountant, you play an interesting and crucial role in our justice system. The discoveries and assessments you divulge on the witness stand can seal the deal in a criminal’s fate.

However, testifying as the joint and impartial expert witness in a trial case isn’t the only service you can perform as a forensic accountant. Consulting is another avenue forensic accounting can lead you down. Read on to learn more about this intriguing career opportunity.

Occupational duties of a forensic accountant consultant

As a forensic accountant consultant, you can:

- Investigate allegations and document your discoveries in financial disputes (divorce, inheritance, contracts, mergers and acquisitions) or business fraud cases for attorneys.

- Help prepare proof-of-loss reports for insurance companies.

- Assist and communicate with senior-level leaders/board members and law enforcement on cases of suspected financial abuse.

- Comb through available financial information, from receipts to tax returns and everything in between, to reconstruct and analyze disputed business transactions.

Consultant vs. star witness

As a consultant, you might perform as a testifying expert in the criminal case you are working on, but it’s rare. An attorney will often retain your services to help them prepare for their case. You’ll dutifully investigate their client’s finances and advise them on financial matters in divorce or suspected fraud cases.

Acting as a consultant often lets you dig deeper into your subject matter. And not having to appear on the witness stand can take away some of the stressors of having to speak on your findings or disclose your work.

Whether you act on behalf of one party in litigation outside of court or as the unbiased expert giving testimony of your findings in court, you’ll approach your research as any CPA would – with due professional care, impartiality, integrity and honor.

Privilege

Depending on who hires you and the duties they expect you to perform, you’ll either disclose your findings to all parties or keep them closely held as privilege for the use of just one party. When hired by a law firm, you’ll carefully protect your findings while communicating your discoveries clearly and truthfully to the legal counsel.

Your work for an attorney falls under attorney-client privilege. Any interpretations and beliefs about your findings, your communications and the material itself are privileged information and do not necessarily have to be divulged to the opposing party or in court (unless instructed by the hiring attorney).

The attorney will lead the legal matters regarding all documents, information and conclusions. Unless instructed otherwise, you won’t publicly testify. Changing from a witness to a consultant can ease many worries about appearing in court.

The benefits of hiring you

Your skill set is invaluable to someone investigating monetary matters and supposed financial abuses. Here’s what you bring to the table:

- Expertise

- Time

- Fresh eyes

- New perspective

- Verification

- Options

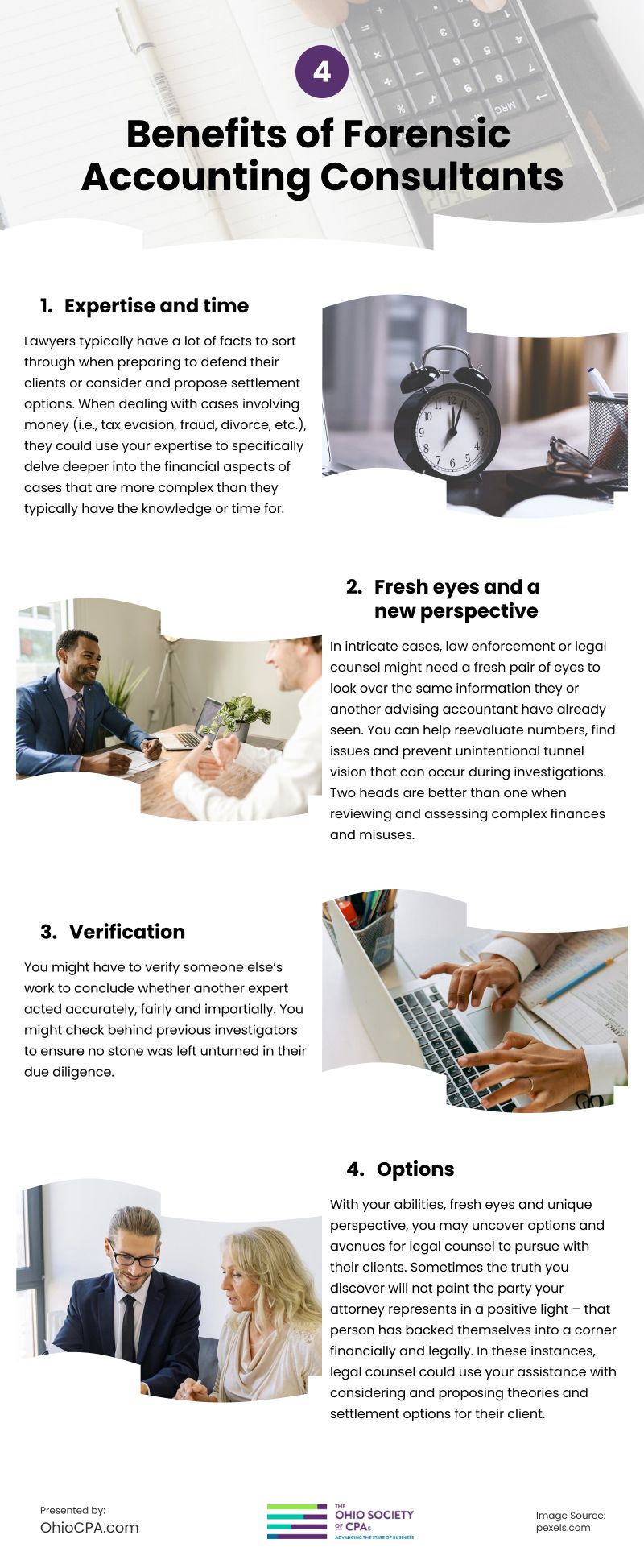

Expertise and time

Lawyers typically have a lot of facts to sort through when preparing to defend their clients or consider and propose settlement options. When dealing with cases involving money (i.e., tax evasion, fraud, divorce, etc.), they could use your expertise to specifically delve deeper into the financial aspects of cases that are more complex than they typically have the knowledge or time for.

Fresh eyes and a new perspective

In intricate cases, law enforcement or legal counsel might need a fresh pair of eyes to look over the same information they or another advising accountant have already seen. You can help reevaluate numbers, find issues and prevent unintentional tunnel vision that can occur during investigations. Two heads are better than one when reviewing and assessing complex finances and misuses.

Verification

You might have to verify someone else’s work to conclude whether another expert acted accurately, fairly and impartially. You might check behind previous investigators to ensure no stone was left unturned in their due diligence.

Options

With your abilities, fresh eyes and unique perspective, you may uncover options and avenues for legal counsel to pursue with their clients. Sometimes the truth you discover will not paint the party your attorney represents in a positive light – that person has backed themselves into a corner financially and legally. In these instances, legal counsel could use your assistance with considering and proposing theories and settlement options for their client.

Becoming a forensic accountant

If forensic accounting sounds appealing to you, it’s always a great time to start pursuing this career path. After earning a high school diploma or GED, the next steps are to obtain a four-year undergraduate degree and then complete the steps for CPA licensure. Finally, you can earn forensic or fraud accounting certification.

In addition to internships and work experience, CPAs on the forensic track must keep up with continuing education courses for accountants. One of the most advantageous and fun ways to bolster your knowledge and improve your skills is by joining an accounting society like The Ohio Society of CPAs (OSCPA) for Ohio accountants. As a member, you’ll enjoy benefits such as on-demand CPE webinars, virtual and in-person conferences and networking opportunities.

The more experience you have in accounting inside and outside of the classroom, the better. A membership subscription to an accounting society like the OSCPA can help you become a well-rounded professional accountant who is ready to pursue any desired accounting career path.

Infographic

One specialized track in the field of accounting is working with the criminal justice system as a forensic accountant. As a forensic accountant, you have a crucial and interesting role in the justice system. Keep reading to discover more about the four benefits of forensic accounting consultants in this infographic.