Illinois passes licensure changes bill

Following in Ohio’s footsteps, Illinois unanimously passed a bill May 22 to create additional pathways to CPA licensure aimed at addressing the national accounting shortage. It now awaits the signature of Governor JB Pritzker.

The legislation, House Bill 2459, amends the Illinois Public Accounting Act to create two additional paths to licensure similar to Ohio’s:

- a bachelor's degree with a concentration in accounting plus two years of work experience;

- or a master's degree with a concentration in accounting plus one year of work experience.

All candidates must still pass the CPA exam. The traditional pathway—150 credit hours, one year of experience, and passing the exam—remains available in Illinois.

The new law also ensures automatic mobility so out-of-state CPAs can serve clients in Illinois without obtaining an Illinois license. The law is set to take effect on Jan. 1, 2027, a year after the Ohio Pathways law will go into effect. Automatic mobility is already effective in Ohio as of April 9, 2025.

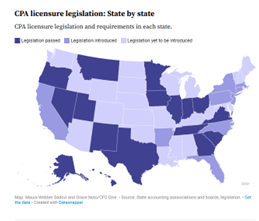

Ohio was the first of now more than a dozen states to pass changes to licensure requirements in an ongoing effort to address the profession's talent shortage. South Carolina, Oregon and Minnesota passed their pathways legislation earlier this month. Virginia, Indiana, Iowa, Montana, Tennessee, Georgia, Texas, New Mexico, Utah, Nevada, Alaska and Hawaii have enacted similar legislation to diversify CPA licensure pathways.

You can monitor real-time legislative changes by state here.