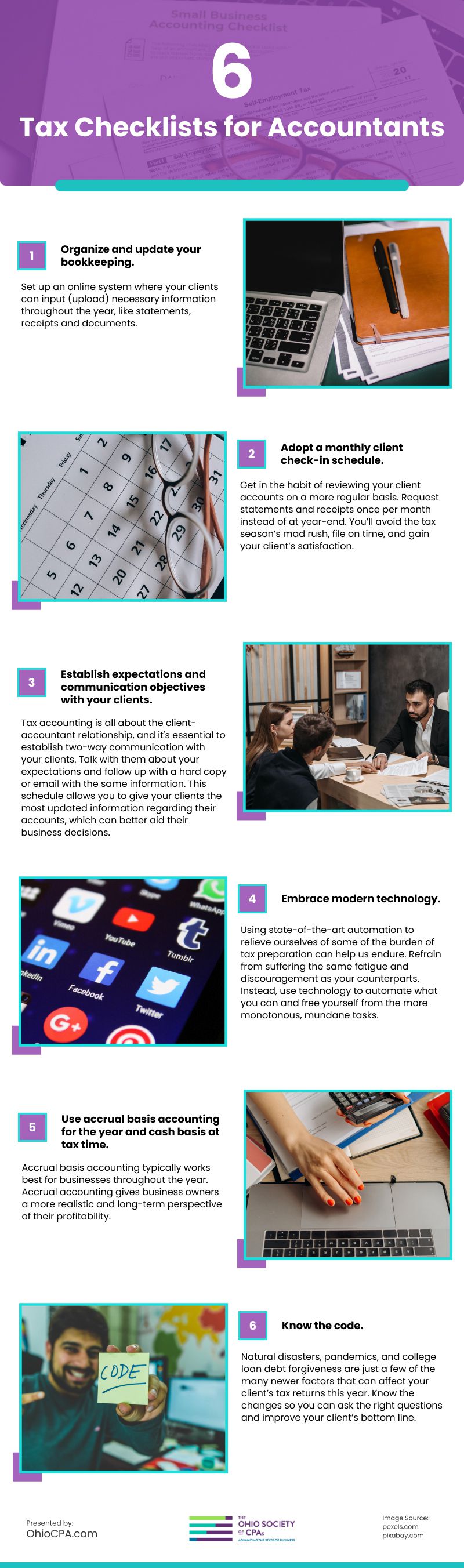

A checklist for a successful tax season

(Amy Hirschi / unsplash)

With new and more efficient technologies simplifying the accounting process, tax duties are shifting to a proactive instead of reactive approach with clients. As a result, tasks are less about manual sorting and data entry and more about relationships and education. With more intricate functions being handled through automation, tax accountants can untangle complex chores, decrease human errors and involve and empower their clients in their own finances.

The new heart of tax prep is a robust client-accountant relationship that involves open and ongoing communication. It’s more important than ever to build a firm working relationship with clients and educate them on the tax process and financial goals while producing accurate and timely reports and tax filings.

Do you have everything you need for the most successful tax season yet?

Organize and update your bookkeeping.

Set up an online system where your clients can input (upload) necessary information throughout the year, like statements, receipts and documents. Make sure that both of you can access it easily. You’ll have less messy paperwork to sort through. Nothing will get lost in the shuffle, and you won’t have to sheepishly ask for something to be resubmitted. You’ll gain valuable time and, perhaps most importantly, your client’s confidence when they see how organized you are.

Adopt a monthly client check-in schedule.

Instead of saving the entire workload for end-of-year taxes, start chiseling away at it monthly. Get in the habit of reviewing your client accounts on a more regular basis. Request statements and receipts once per month instead of at year-end. You’ll avoid the tax season’s mad rush, file on time, gain your client’s satisfaction, and help educate them on which expenses to pay closer attention to in the future.

Establish expectations and communication objectives with your clients.

More now than ever before, tax accounting is about the client-accountant relationship. As with any good relationship, it's essential to establish two-way communication, boundaries and roles.

Speak regularly and genially with your clients to strengthen your bond. Talk with them about your expectations and follow up with a hard copy or email with the same information. For example, let them know about your procedures, how to respond and how much time is reasonable for a response (from you and them). Instruct your clients on how and when to submit proper documentation.

Meet with complex or high-value clients once per month. This schedule allows you to give your clients the most updated information regarding their accounts, which can better aid their business decisions.

Embrace modern technology.

Burnout is all too common in our industry. The Great Resignation resulting from the pandemic can continue to snowball out of control if we don’t do what we can to stop it. Using state-of-the-art automation to relieve ourselves of some of the burdens of tax preparation can help us endure.

With today’s staffing shortages, you’re likely working at maximum capacity already. Don’t suffer the same fatigue and discouragement as your counterparts. Instead, use technology to automate what you can and free yourself from the more monotonous, mundane tasks. For example, the right software can compile statements, enter data, reconcile accounts and do your reporting for you. In addition, it can automatically send statement requests to your clients and then fill in the ledger with their provided data.

You must find the best programs to suit your needs and commit yourself to learning how to use them.

Use accrual basis accounting for the year and cash basis at tax time.

Accrual basis accounting typically works best for businesses throughout the year. With accrual accounting, business owners have a more realistic and long-term perspective of their profitability.

However, because money owed to a business isn’t always neatly secured by tax time, switching to a cash basis for tax purposes makes the most sense. Clients can avoid paying taxes on income that hasn’t been realized yet.

Comfortably switching back and forth between the two accounting bases will avoid confusion and ensure that your clients are maximizing their financial potential.

Know the code.

Stay updated on the most current tax code changes. Natural disasters, pandemics and college loan debt forgiveness are just a few of the many newer factors that can affect your client’s tax returns this year. Know the changes so you can ask the right questions and improve your client’s bottom line.

Infographic

As tax season approaches, accountants can quickly become overwhelmed by the abundance of work they must complete. However, utilizing modern technology and taking advantage of accessible resources doesn't have to result in a stressful experience. To make this taxing time more manageable, we've created an infographic checklist for successful preparation during tax season - helping you stay organized so everything is taken care of.

Video