OSCPA proposes law changes to CPA licensure

A message from OSCPA CEO & President

For over two years, we have been listening and learning from our members and collaborating with other state partners about the outdated and counterproductive policies that currently govern CPA licensing laws in our state.

Protecting the Ohio business community, advancing the CPA profession and creating a strong, stable talent pipeline are consistent priorities for our profession and our members. Late last month the OSCPA Board, driven by our commitment to protect the integrity and impact of the CPA profession, unanimously voted to actively pursue essential legislative changes affecting interstate mobility and the educational pathways to certification. Ohio legislation is expected to be considered as soon as this week to address these areas.

Ohio has long been a leader in advocating for improvements that strengthen the CPA profession while maintaining trust in our practice. In this effort, we are joining dozens of other states currently working to strengthen our profession via legislative reform of the following issues:

Removing Barriers to Working in Ohio

In a time of CPA shortages and a shrinking pipeline of future licensed professionals, we must take control of our own workforce and the future of our profession to ensure Ohio businesses and government entities have access to the expertise they need – even when those CPAs are located in another state. We believe that future interstate mobility should be clear: if an out-of-state licensed CPA is in good standing in their home state and meets professional standards, they should be able to respond to the professional requests of Ohio clients. Period. Automatic mobility, as OSCPA is proposing, strengthens existing interstate mobility laws by ensuring national third-party interests cannot deny Ohio businesses access to qualified accounting experts no matter which state they primarily work in. We are not alone: more than 20 other states, representing nearly 75% of all US CPA license holders, have indicated they also are pursuing automatic mobility in the near future, ensuring comparable enhanced opportunities for Ohio’s CPAs. This includes the four states that already have automatic mobility.

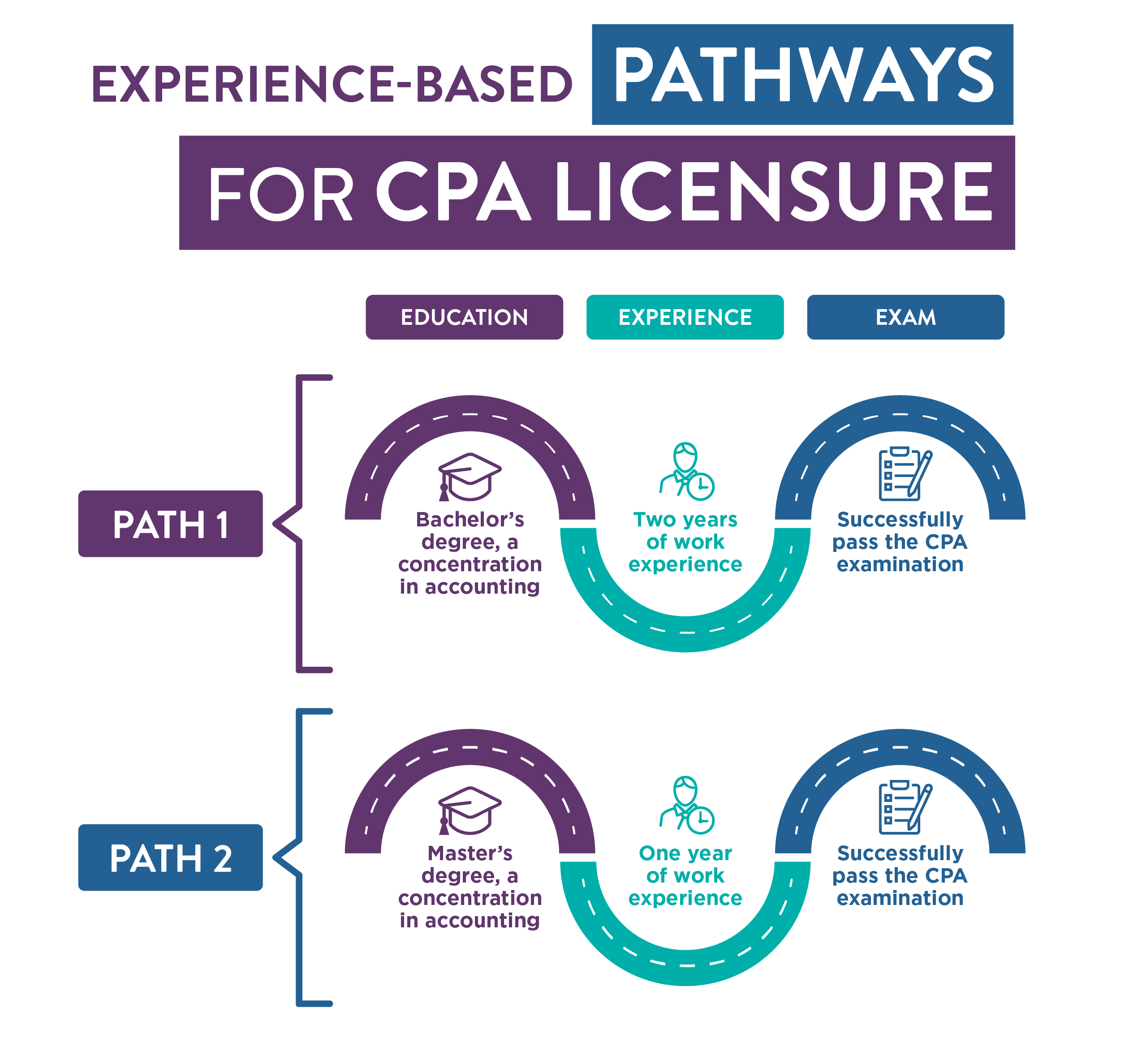

Experience-Based Pathways

Our workforce is dynamic and vital. To secure its future, we need to expand it. Through active discussions with our members and other states, we believe that the adjustment to the education pathways for becoming a CPA is a necessary step in part to offset the obstacles recently shared by the Center for Audit Quality and MIT.

Our proposed law changes for CPA licensure include two pathways to meet the education requirement:

Bachelor’s degree, a concentration in accounting, two years of work experience and successfully passing the CPA examination, OR

Master’s degree, a concentration in accounting, one year of work experience, and successfully passing the CPA examination

These pathways, paired with strengthened interstate mobility, are critically important solutions to ensure employers and users of CPA services continue to have access to top talent now and into the future.

We are continuing to engage in conversations with the Accountancy Board of Ohio, Ohio policymakers, other states pursuing similar legislative updates, and national accounting organizations. We encourage and welcome your input as well, and we will keep you informed as the situation develops. If you have questions or concerns, please contact [email protected].

Sincerely,

-9-copy.jpeg?sfvrsn=56dcfa67_1)

Scott D. Wiley, CAE

President & CEO

The Ohio Society of CPAs