Cash flow problems plaguing small businesses

(Karolina Grabowska / pexels)

Cash flow suffers when customers don’t pay their bills on time or in full. Cash flow troubles create a domino effect on a business’s entire operation and reputation.

Entrepreneurs will, in turn, encounter difficulties paying their own bills, which ruins their relationships with vendors, customers and employees. They lose out on good credit terms with vendors and lenders. They can’t meet customer demands and begin to lose out to competitors. To top it off, they’ll lose employees who can’t trust the boss to pay on time.

Accounting and finance professionals help business owners take control of their cash flow to produce a healthier economy. Once you know the red flags to look for in your client’s business, you can help them correct course and learn better cash flow management practices.

Postponed payments

A study by Xero says as many as half of all payments made to small businesses are late. Some won’t receive compensation for more than 30 days, which creates financial problems down the line.

Small businesses can’t meet their own obligations, like paying employees or rent on time when accounts are in arrears. Nor can they invest in themselves to grow and stay competitive.

Reducing late payments by any percentage positively impacts cash flow. Entrepreneurs typically don’t have time to chase down payments on outstanding accounts. They need help from accountants and technology.

Elevated expenses

The current inflationary economic climate is a massive disruption to cash flow. Commodities (like oil) are more expensive, which trickles down to almost everything else you can think of and increases prices everywhere.

Additionally, supply chain kinks and lack of supplies drive prices up. Combine inflation with a tight labor market that’s forcing increases in payroll expenses, and it’s no wonder small business owners have severe setbacks maintaining optimal cash flow.

Things cost more, but not all small businesses can pass those increases on to the customer, so they eat it. Those with a better handle on money coming in can afford to compete better in a challenging market.

Cyclic slack

Slowdowns happen at certain times of the year for all businesses. Even those not closely tied to specific times or seasons typically experience less revenue in January and February than during the rest of the year.

Small businesses that receive adequate, on-time payments have better hope of riding out dry spells due to seasonal cycles. Cash flow is even more problematic for those whose expenses and receivables are out of control or unmonitored.

Solutions

Accountants can help clients attack their cash flow problems from four different angles. First, help clients better understand their expenses and find ways to reduce them. Review expenses regularly. Ask current suppliers about better pricing, such as discounts on larger orders or better credit terms. Sometimes, an entrepreneur needs to find a new supplier to lower costs. Review recurring fees, like subscriptions or advertising expenses, and help clients determine which are worth keeping and which aren’t.

Secondly, accountants can recommend faster billing and payment solutions to speed up the process of invoicing and collecting money from customers. For example, software solutions that invoice and collect payments electronically can reduce the time it takes for a business owner to get paid while saving an employee (or entrepreneur) the time it takes to track and request reimbursement from customers. Overdue accounts automatically receive reminders. Offering discounts on early payments, better credit terms, and different payment methods can also boost payment rates.

Not all entrepreneurs can budget effectively, and business finances are sometimes difficult to fully comprehend. Accounting and finance professionals can help owners make and stick to a budget. A sensible budget requires excellent bookkeeping, and accountants can help owners with the tech and knowledge to maintain quality records. With careful planning and budgeting, accountants can help business owners with the following stepping stones: cash flow optimization, future predictions and forecasting to enhance a client’s business decisions.

Once accountants have helped clients secure internal cash flow, they can assist them with securing external funding to get through slumps, if and when necessary. Accountants can back clients with the lending process, helping them look good financially and receive the best terms possible.

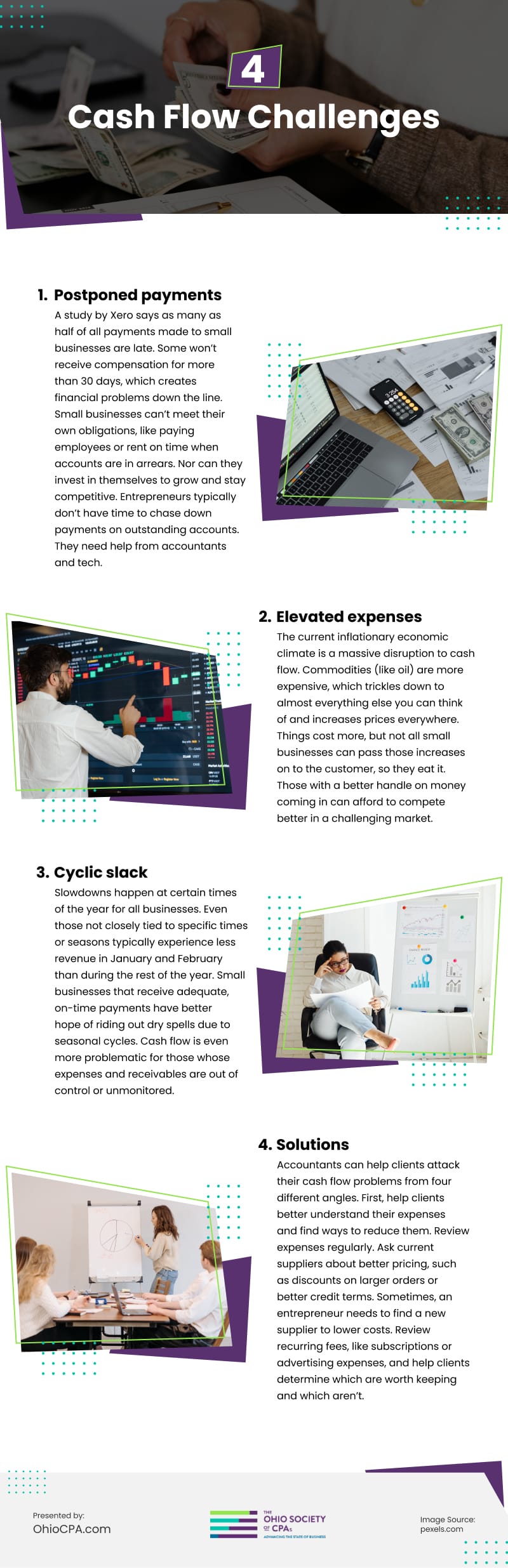

Infographic

Intuit QuickBooks' study reveals cash flow woes as primary for small businesses. Delayed payments, rising expenses, and seasonal revenue lulls exacerbate financial strain. Accountants provide vital support through expense reduction and streamlined billing solutions. Understand the red flags with the help of our infographic to solve cash flow problems effectively.

Video