Challenges accountants face with cryptocurrencies

(Zan / unsplash)

Cryptocurrency and digital markets are so new and nuanced that accounting for them on financial statements and tax returns has been a significant challenge. Accounting, tax and auditing firms increasingly see cryptocurrencies affect their daily operations and records. Moreover, accounting regulations haven’t kept pace with the burgeoning market, and we lack global agreement on protocols for dealing with it.

The uses of crypto

It’s unfamiliar, complex and gaining in popularity, making learning everything we can and staying up-to-date on the newest information all the more important from an accounting standpoint. Currently, cryptocurrencies can function as investments, currencies or earnings. The distinctions can be subtle, but all “intents and purposes” behind the exchange or holdings ultimately make all the difference.

Digital currency transactions include:

- Purchasing goods or services

- Exchanging one kind of crypto for another

- Selling for fiat currencies, like the U.S. dollar

- Earning a payment or reward for validating a block in the chain

Accounting challenges:

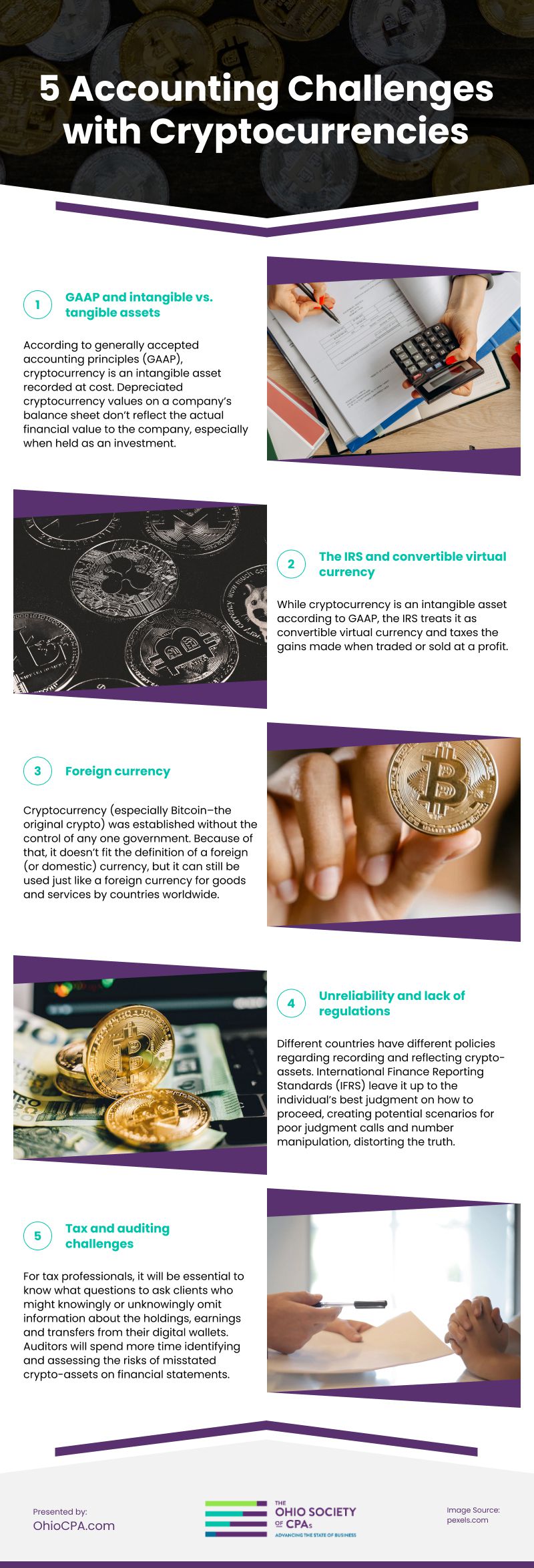

GAAP and intangible vs. tangible assets

According to generally accepted accounting principles (GAAP), cryptocurrency is an intangible asset recorded at cost. However, a few things don’t quite add up when classifying crypto as an intangible asset, like depreciation. Depreciated cryptocurrency values on a company’s balance sheet don’t reflect the actual financial value to the company, especially when held as an investment.

And how about the fact that this particular intangible digital asset can be tied to something tangible? In our computerized age, new digital assets, similar to Bitcoin, are making their debuts at fast speeds, and those abstract assets can easily be traded for real ones like products, services and cash.

The IRS and convertible virtual currency

While cryptocurrency is an intangible asset according to GAAP, the IRS treats it as convertible virtual currency and taxes the gains made when traded or sold at a profit.

Foreign currency

Furthermore, cryptocurrency (especially Bitcoin–the original crypto) was established without the control of any one government. Because of that, it doesn’t fit the definition of a foreign (or domestic) currency, but it can still be used just like a foreign currency for goods and services by countries worldwide.Unreliability and lack of regulations

Globally, different countries have different policies regarding recording and reflecting crypto-assets. International Finance Reporting Standards (IFRS) leave it up to the individual’s best judgment on how to proceed, creating potential scenarios for poor judgment calls and number manipulation, distorting the truth.

Additionally, the cryptocurrency market has been volatile throughout its brief history, creating reliability issues for anything written on a balance sheet or tax document.

Tax and auditing challenges

With policies that fall short of how to best classify and explain cryptocurrency, it’s no surprise that accountants are facing challenges. So, too, are tax pros and auditors.

For tax professionals, it will be essential to know what questions to ask clients who might knowingly or unknowingly omit information about the holdings, earnings and transfers from their digital wallets.

Auditors will spend more time identifying and assessing the risks of misstated crypto-assets on financial statements. The anonymous nature of these assets will add to the difficulties for auditors and tax accountants in recognizing a crypto-asset-related transaction reflected incorrectly on financial statements.

Advanced technology for enhanced accounting

Enterprise resource planning (ERP) software automatically tracks foreign currencies’ market values.

Cryptocurrency exchanges monitor the monetary value of digital assets around the clock to facilitate exchanging crypto for the equivalent dollar amount.

Utilizing technologies like these would make it easier for accounting professionals and their clients to track the value of their digital holdings and spending in real time. Also helpful is accounting software that allows more than a two decimal place limit. The technology exists but hasn’t yet garnered widespread use across accounting software.

Opportunities arising from challenges

With the complexity of cryptocurrency comes the opportunity for accounting, tax and auditing services to grow their business as more companies and individuals reach out for compliance, advising and auditing services. As an individual or company’s number of crypto-assets, transactions and customers increase, so do the complications and ramifications.

It’ll be up to us to learn all we can so we know the right questions to ask. Questions about the intentions and purposes behind clients’ cryptocurrency holdings, earnings, transfers and exchanges. Questions about whether the assets are stored in a personal or corporate digital wallet or with a third party. Until knowledge, experience, technology and human resources catch up to the alarming growth rate in the digital currency markets, it will be up to accountants, tax professionals and auditors to regulate and guide individuals and businesses into the digital future.

Learn more and get CPE credits online

The Ohio Accounting Shows are back this October and November 2022. Register now to reserve your space at a discounted price and take advantage of continuing education credits for accountants in Ohio. We’ve picked the best lineup of speakers, like Dr. Sean Stein Smith, Ph.D., DBA, and CPA, to share their expertise on core topics and emerging disciplines,

Video

Infographic

The world of cryptocurrency and digital markets is relatively new and complex, making it difficult to account for them on financial statements and tax returns. Accounting, tax, and auditing firms are increasingly finding that cryptocurrencies are affecting their daily operations and records. Keep reading to learn more about accounting challenges with cryptocurrencies in this infographic.